Sat, May 10, 2025

Markets are calming as President Trump gradually backtracks on the most strident elements of his trade war. Nobody would complain if the trend continued.

Peak panic in the trade war occurred in early April, after Trump announced "reciprocal tariffs" on dozens of countries that were far steeper than nearly anybody expected. A savage market sell-off compelled Trump to delay many of those tariffs for three months. US stocks have been rising since late April, and the year-to-date decline in the S&P 500 (^GSPC) is now just 4% — a lot better than the 15% drop as of April 8.

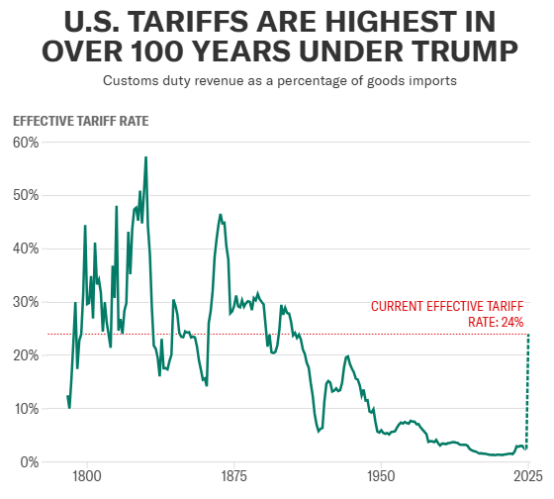

Trump's latest walkbacks are a relaxation of some tariffs on British imports and a suggestion that he could lower astronomical tariffs on Chinese imports to less-astronomical levels. US and Chinese negotiators will meet soon to open talks about a possible trade deal. The overall tariff rate on imports is still around 24%, up from 2.5% when Trump took office. But the positive developments have revived investor hopes that maybe Trump's tariffs won't be so damaging after all.

The real economy may also get a reprieve. The odds of a recession in betting markets have dropped to 51% from a peak of 66% on May 1. Those odds are a kind of crowdsourced estimate, not an economic forecast.

But some economists are also getting a bit more optimistic. Yardeni Research raised its recession odds from 20% when Trump took office to 35% on March 5 and 45% on March 31. The firm is now dialing that back to 35%.

"We believe that China and the US both may be ready to suspend their tariffs on each other while they negotiate a trade deal," Ed Yardeni, president of the research firm, wrote in a May 9 analysis. "Neither side can bear the pain of a trade war. We also expect that Trump will declare victory in his trade war with the rest of the world. By the end of the 90-day postponement period of his reciprocal tariffs, the US is likely to have signed numerous agreements with America's major trading partners."

Wouldn't that be nice! The early July deadline for Trump's three-month delay on most reciprocal tariffs will roughly coincide with the moment US retailers start to run out of pre-tariff inventories, especially goods from China. Once the pre-tariff stuff is gone, shoppers will notice sharply higher prices on some imported goods while other products simply disappear from shelves. The tariff on Chinese imports is now as high as 145%, a tax hike so large that most of those tariffed goods are no longer arriving at US ports.

Some people who have worked with Trump feel sure he'll reduce his trade war to manageable proportions. "He's not a rigid person who will not adapt," former House Speaker Kevin McCarthy said at the recent Milken Institute Global Conference in Beverly Hills, Calif. "At the end of the day, he's not going to have the shelves empty."

Averting a recession and keeping store shelves stocked is hardly the best-case scenario. If Trump had never launched his trade war in the first place, stock values would probably be higher, interest rates lower, and recession odds negligible. When Trump took office in January, the inflation surge that vexed the Biden administration was nearly over, and growth, hiring, spending, and investment looked solid. Trump's trade war is basically the only thing that has darkened the economic outlook in 2025.

If trade deals and other moves can lower the average tax on imports to around 10%, many businesses will breathe a sigh of relief. "One of the big questions is what is the magnitude of the tariffs," Citigroup CEO Jane Fraser said at the Milken conference. "If it's 10%, most companies say we can absorb that. If it's 25%, not so much."

Businesses may not get that lucky. Goldman Sachs estimates that the average tariff rate will settle at around 17%, seven times higher than when Trump took office. The rising cost of imports would push the overall inflation rate from 2.4% now to nearly 4% by the end of the year. The biggest price jumps would come in used cars, appliances, electronics, pharmaceuticals, and clothing.

As for the overall economy, Goldman expects GDP growth of just 0.5% in 2025. At the start of the year, Goldman expected 2.4% GDP growth. The Trump slowdown may not become a recession, but no boom is on the way, either.