Sat, June 7, 2025

The US labor market is cooling. The president keeps clamoring for the Federal Reserve to cut interest rates.

But Wall Street still doesn't think it's happening anytime soon. Currently, markets are not pricing in more than a 50% chance of a Fed rate cut until the central bank's September meeting, per the CME FedWatch Tool.

One reason why appeared in two different data releases over the past week: Wage growth remains particularly resilient.

The May jobs report showed average hourly earnings rose 0.4% over the last month and 3.9% over the prior year, higher than the 0.2% monthly wage growth seen in April.

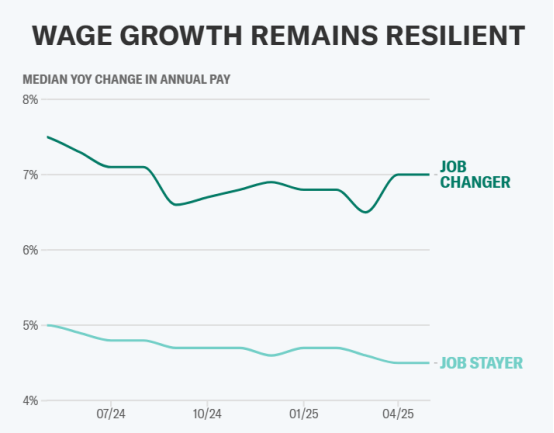

Meanwhile, data from ADP showed wages for workers in the private sector who changed jobs grew 7%, while wages for those who stayed in the same job grew 4.5%. Both were unchanged from the month prior.

As our Chart of the Week shows, in the past six months, wage growth for job stayers has fallen just 0.2 percentage points while pay gains for job changers have actually increased by the same amount. The gap has widened — and stayed that way.

So when the president took to social media to say the smallest private payroll gain in over a year was a reason "Powell must now LOWER THE RATE," ADP chief economist Nela Richardson pointed to wages.

"The labor market isn't collapsing," Richardson said. "Wages are robust, but they're not triggering inflation. Hiring is slow, but it's not leading to outside layoffs. So in that sense, there's nothing in the labor market that points in any direction [for the Fed] strongly."

Such is the "totality" of the data.

In a note titled “May-day? More like Pay-day!" Bank of America US economist Shruti Mishra remarked that solid wage income growth is “supportive of consumption but will also likely keep the Fed in their inflation fighting stance.”

The chart also reveals a key piece about the state of the US economy and consumer. The great resignation may be over, but leaving a job is still providing workers with pay bumps. And those who stay are still seeing wages growing above the 2.3% headline inflation increase seen in April.

his doesn't help those who are struggling to find work. And as we highlighted last week, there are plenty of displaced workers right now, particularly recent college graduates.

But the fact is, the statement from Fed Chair Jerome Powell in January that it's "all good" if you have a job remains true. That's a key piece of why recession risks have fallen amid the tariff rollback of the past month and the stock market has soared back within striking distance of all-time highs.

"As long as wages are robust, layoffs are low, and consumers can keep spending, I think that even if the economy slows for a period of time, it is resilient enough to rebound," Richardson said.