Social Security is widely considered a ‘third rail’ in American politics, meaning it’s so controversial that most politicians simply avoid touching it.

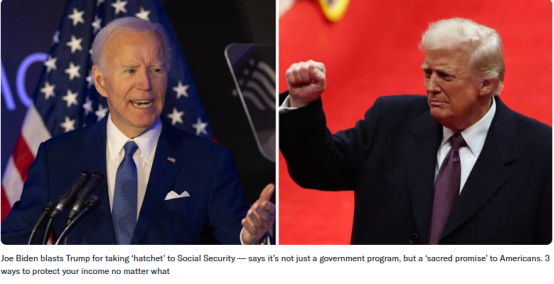

But 100 days into his second administration, President Donald Trump hasn’t just touched the system but taken a “hatchet” to it, according to former president Joe Biden.

"This new administration has done so much damage and done so much destruction. It's kind of breathtaking," said Biden at a conference in Chicago.

He also took aim at billionaire Elon Musk, whose team has pushed spending and staffing cuts at the Social Security Administration (SSA) and has called the system "the ultimate Ponzi scheme of all time."

"What the hell are they talking about?" Biden said. "Social Security is more than a government program. It's a sacred promise we made as a nation."

Democrats and the former president are not the only ones alarmed by Trump and Musk’s recent moves on the nation’s retirement safety net. Public concerns about the system’s future reached a 15-year high, according to a recent Gallup poll.

If you share these concerns, here are three ways you can bolster your retirement income regardless of what happens to Social Security in the future.

Don't miss

I'm 49 years old and have nothing saved for retirement — what should I do? Don't panic. Here are 5 of the easiest ways you can catch up (and fast)

Thanks to Jeff Bezos, you can now become a landlord for as little as $100 — and no, you don't have to deal with tenants or fix freezers. Here's how

Nervous about the stock market in 2025? Find out how you can access this $1B private real estate fund (with as little as $10)

Maximize retirement accounts

With the social safety net at risk, it might be a good time to consider weaving an independent safety net by maximizing your tax-sheltered retirement accounts.

Ramp up contributions to your 401(k) or Roth IRA plans to start creating a self-sufficient retirement fund.

Take the time to learn about Health Savings Accounts (HSAs) and start saving for any medical bills you may have to deal with in your senior years.

This is also a great time to reach out to a professional tax planner or investment advisor to understand how you can bolster your long-term savings and investment plans.

Look for alternative streams of passive income

Most retirees rely on a combination of dividends from stocks, interest payments from savings accounts and Social Security benefits to fund their retirement. But with the last one in jeopardy, it might be a good idea to consider alternative sources of passive income.

A rental property is a good example and is widely considered a reliable source of passive income.

According to Zillow, the median age of a landlord is 59 years old. If you start your real estate journey early, you could create a property portfolio that supplements any other sources of retirement income you may have.

Consider moving and downsizing in retirement

If you don’t have the time or money to create your own retirement plan and insulate yourself from any potential disruptions to Social Security, it might be time to get creative.

If you don’t already live in a state that doesn’t tax your Social Security benefits, consider moving to one with a lower cost of living in general, or perhaps even out of the country. This could reduce the amount of money you need to live comfortably in retirement.

Kathleen Peddicord, founder and publisher of Live and Invest Overseas, told CNN Travel that American seniors account for 80% of the site’s traffic and that visits surged 250% above average in the days after the U.S. election. Many retirees see the appeal of moving to Panama, Portugal or Malaysia insteading of financially struggling in America.

Downsizing your home is another lifestyle adjustment that could make your retirement more comfortable. This isn’t a popular option, as 84% of American seniors consider aging in place a priority, according to a recent survey by Point, a home equity investment company.

However, for those who are struggling to make ends meet in their senior years, unlocking some of the equity built up in their home could be a good way to meet essential expenses.

What to read next

Want an extra $1,300,000 when you retire? Dave Ramsey says this 7-step plan ‘works every single time’ to kill debt, get rich in America — and that ‘anyone’ can do it

Rich, young Americans are ditching the stormy stock market — here are the alternative assets they're banking on instead

There's a 60% chance of a recession hitting the American economy this year — protect your retirement savings with these essential money moves ASAP (most of which you can complete in just minutes)