Updated Sun, August 10, 2025

The auto sector is taking President Trump's tariffs on the chin. Toyota (TM), the world's largest automaker, was the latest to reveal the impact it's seeing from tariffs in its earnings on Thursday morning, with slightly over $3 billion wiped from its fiscal Q1 (June 30) operating income.

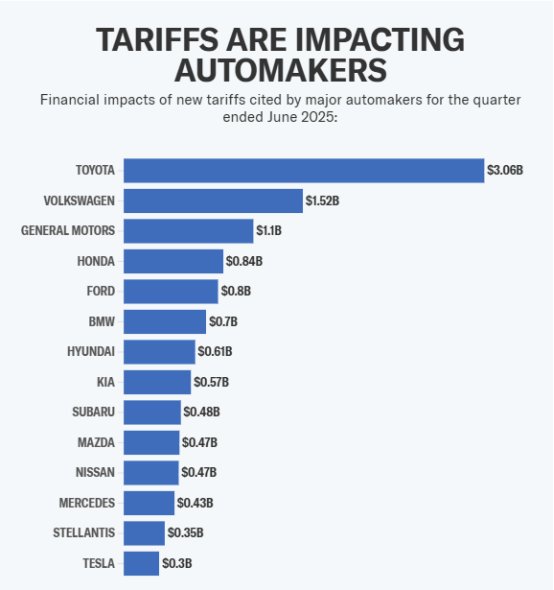

With Toyota's results in, the cumulative tariff hit from the largest automakers following the end of the June quarter stands at around $11.7 billion, per automakers' financial disclosures. Toyota had the largest exposure, followed by rivals like Volkswagen (VWAGY), GM (GM), Ford (F), Honda (HMC), and others. China's top automakers were excluded from the list as they do not operate in the US.

Automakers, including Toyota and Honda, are not only seeing imports from their home market of Japan hit with tariffs (15%). They're also dealing with higher overall auto sector tariffs of 25% impacting operations from countries like Canada and Mexico. This also goes for the Big Three — Ford, GM, and Stellantis — which have significant operations with US-Mexico-Canada Agreement (USMCA) partners.

Even Tesla (TSLA), which makes all of its vehicles in the US, had a significant tariff impact from duties on auto parts like batteries for EVs.

"The cost of tariffs increased around $300 million with approximately two-thirds of that impact in automotive and less in energy. However, given the latency in manufacturing and sales, the full impacts will come through in the following quarters," Tesla CFO Vaibhav Taneja said on the company's earnings call on July 23.

The knee-jerk reaction for automakers would be to raise prices while eventually moving toward more US production. But neither option is an easy fix to avoid tariffs.

"Investment for new assembly plants is considerable and requires a larger rationale than a one-term presidential administration," AutoForecast Solutions auto manufacturing expert Sam Fiorani said. "Building a new factory requires three to five years of planning and, likely, one or two billion in investments. Even retooling an existing facility will need around half a billion dollars."

Fiorani noted that the financial outlays for factory spending have to be weighed against the cost of paying tariffs over the next three years.

Most high-volume models, which typically have lower profit margins, like the Nissan Rogue, are already built in the US. Moving some high-volume vehicles that are built at scale in a foreign location, like the Chevrolet Equinox, may not make sense to move to the US. On the flip side, building certain low-volume, high-profit vehicles in the US wouldn't make economic sense either.

How automakers are responding

For its part, GM said it will spend $4 billion to bring more truck and SUV production to the US.

GM said it will add production of the gas-powered Chevrolet Blazer and Chevrolet Equinox, currently made in Mexico, to the US starting in 2027. GM will also begin making gas-powered full-size SUVs like the Chevrolet Tahoe and light-duty pickups like the Silverado at its plant in Orion, Mich. It will also shift EV production from that plant to the Factory Zero Michigan plant, which produces only EVs.

Honda said this week it is considering adding a third shift to its US production facilities to blunt the effect of tariffs. Though Honda didn't say which models would be affected, it had reportedly considered moving Civic sedan production from Canada to the US, which Honda denied.

Adding a third shift would enable the automaker to limit tariff exposure and avoid the cost of constructing a new factory or adding tooling for a new production line somewhere else.

But Honda isn't out of the woods either. CFRA's Garrett Nelson believes its margins will remain "deeply negative due to unabsorbed EV transition costs and structural tariff headwinds," which Nelson wrote could worsen if Trump's tariff policies ramp up again.

Even Tesla is looking to onshore some of its parts production. Tesla vice president of engineering Lars Moravy said during the Q2 earnings call that Tesla's use of LFP batteries from China was a major source of tariffs, and that the company's first LFP battery factory would be coming online by the end of the year to defray some of those costs.

The other alternative to evading the margin-eating costs of tariffs would be to pass those costs to buyers.

"In the short term, automakers did carry the costs and it showed up in the second quarter financial reports," Fiorani said, adding that at some point, something has to give, with prices rising.

"While it will vary depending on the profit margin on luxury models versus the need to be price competitive on the lower end, consumers of all vehicles, imported or not, will find prices going up starting this fall and increasing more next year."

Ford initially instituted an "employee pricing for all" campaign for most models, effectively cutting prices in the face of tariffs and likely eating into its pre-tariff inventory. That only lasted until the end of June. Ford has since moved prices higher, especially for products like the made-in-Mexico Maverick pickup.

GM, for its part, said it hasn't had to discount at all to maintain its pricing power and that it did not have any specific actions in place to hike prices. One way, however, that automakers can raise profits without hiking retail prices is by removing incentives and charging more for financing.

"We think automakers are doing everything possible to offset tariff impacts through a combination of cost cuts, pricing, and mix, but the fact is they're going to have to absorb a large percentage of the impact of tariffs," CFRA's Nelson said to Yahoo Finance.

Nevertheless, even if automakers are able to move production to the US, cut unprofitable products, and streamline operations and costs, it seems one thing will remain true for the foreseeable future.

"Everyone will pay more," Fiorani said.